3 in 10 unbanked are between the ages of 15 and 24

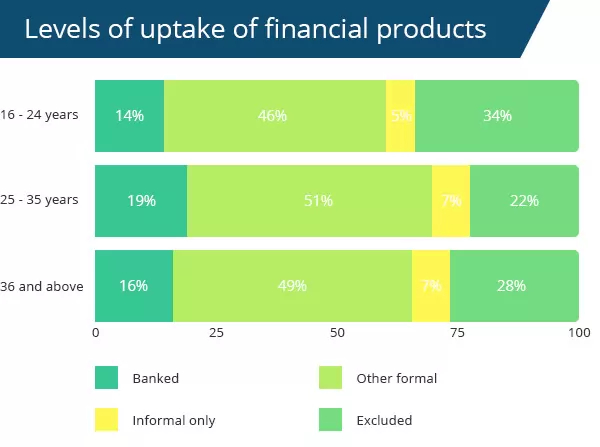

At just over 7 million, the 16 to 24-year-old segment in Tanzania makes up over a quarter of the adult population, but accounts for a third of the overall financially excluded population.

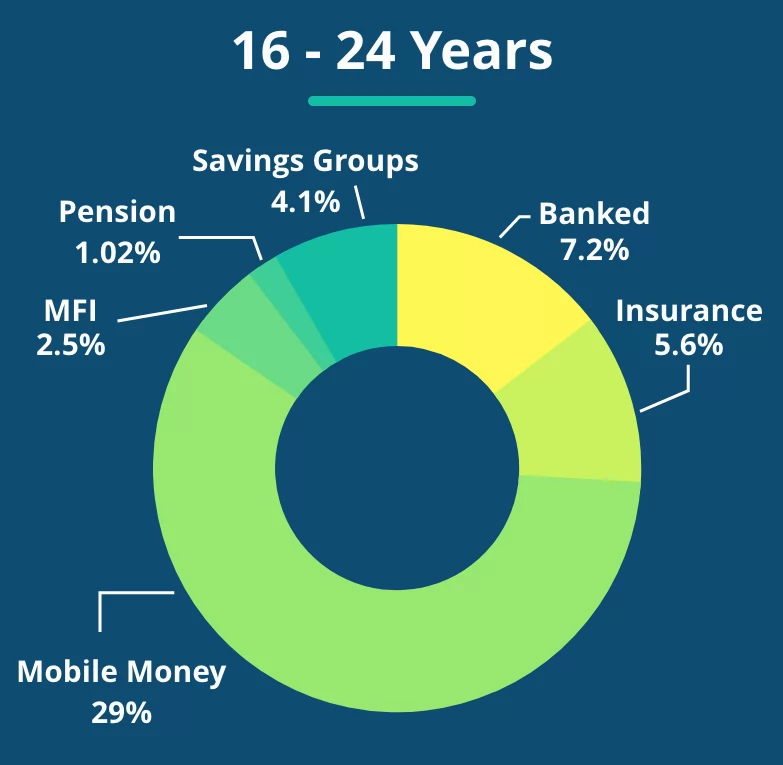

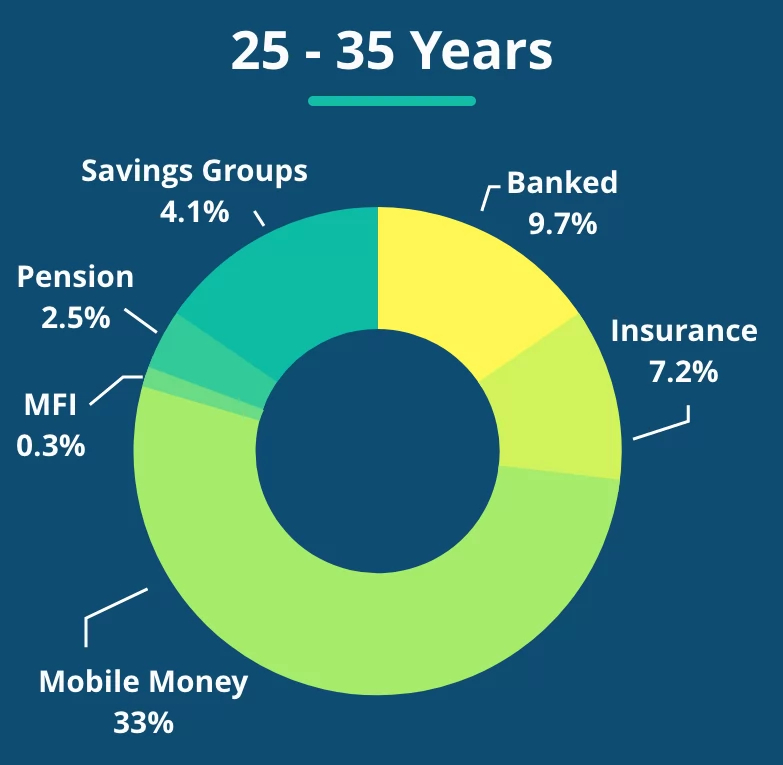

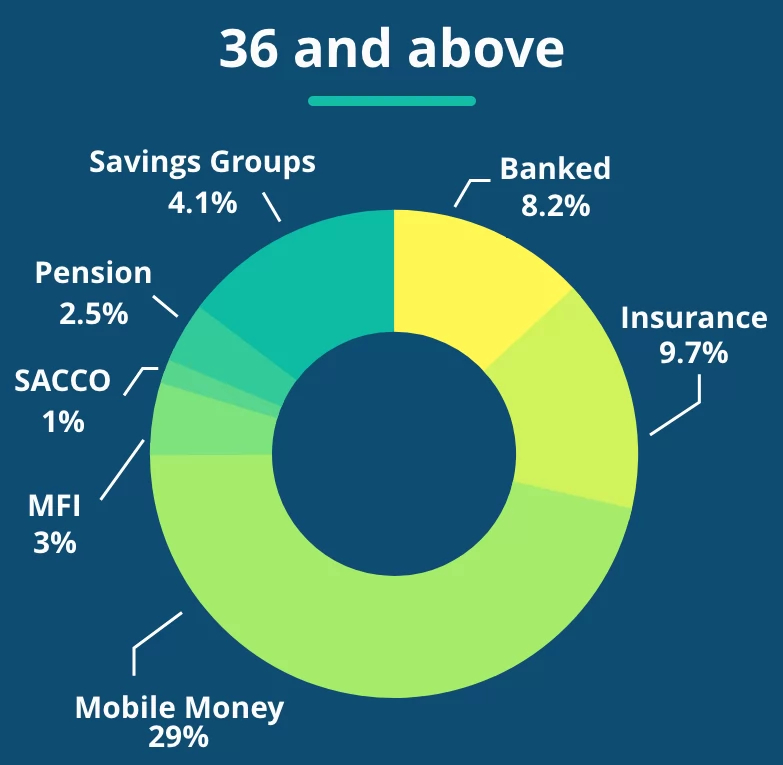

In terms of their participation in the financial sector, over 50% of youth use mobile money, but their take-up of formal banking, insurance, credit and savings products and services is low. This presents a significant opportunity for public and private stakeholders to find innovative ways to improve their financial inclusion and enable them to contribute to the financial growth of the country.

Of youth are mainly dependent

Of 15 – 35 years old are unemployed

Of Tanzanian youth aspire to have their own businesses

6 out of 10 of Youth held some form of ID

Live in urban households which have a mobile phone

Source: FinScope Tanzania

Challenges

Considered a difficult and unprofitable market to serve, young people face a range of challenges in accessing and using financial solutions related to their low levels of civic participation, economic activity and human capital.

Considered a difficult and unprofitable market to serve, young people face a range of challenges in accessing and using financial solutions related to their low levels of civic participation, economic activity and human capital.

The challenges can be considered in terms of customer protection requirements, limited product offering and low financial education.

Such challenges include:

- Lack of documentation required by Know-Your-Customer requirements

- Lack of collateral as only 11% claim to own land and of them, only 20% have proof

- Lack of youth-targeted solutions

- Low levels of financial literacy and numeracy

- Tendency to adopt informal financial services once independent from family

- High levels of unemployment and dependency on others

- Perception among financial service providers that they are a difficult and unprofitable market

FSDT’s strategy for youth

FSDT strives to support evidence-gathering and sharing to promote the potential opportunities of the youth market.

In our role of thought-leadership, we are working with public and private stakeholders to develop forward-thinking strategies to encourage young people to take advantage of the benefits of financial solutions and so realise their financial prospects.

Our programme approach puts youth at the centre of our work, seeking to identify and meet their needs across all our initiatives.

FSDT strives to support evidence-gathering and sharing to promote the potential opportunities of the youth market.

In our role of thought-leadership, we are working with public and private stakeholders to develop forward-thinking strategies to encourage young people to take advantage of the benefits of financial solutions and so realise their financial prospects.

Our programme approach puts youth at the centre of our work, seeking to identify and meet their needs across all our initiatives.