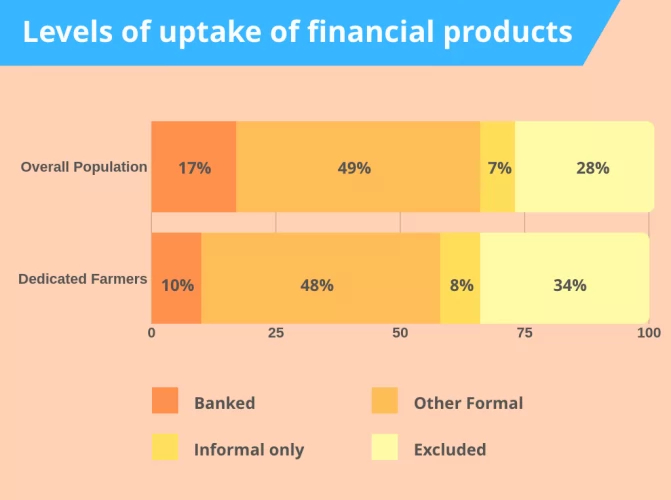

Only 10% of farmers use banking services

Agriculture is the backbone of Tanzania’s economy, as the largest single sector, contributing 29% (2016)[1] to the country’s GDP. Access to finance is a key factor in the continued growth of this economy, yet both smallholder and agribusiness finance continue to be considered high risk by the financial community. This has hampered the development of financial services and products suited to agriculture and limited penetration of micro-finance and formal bank finance in rural areas.

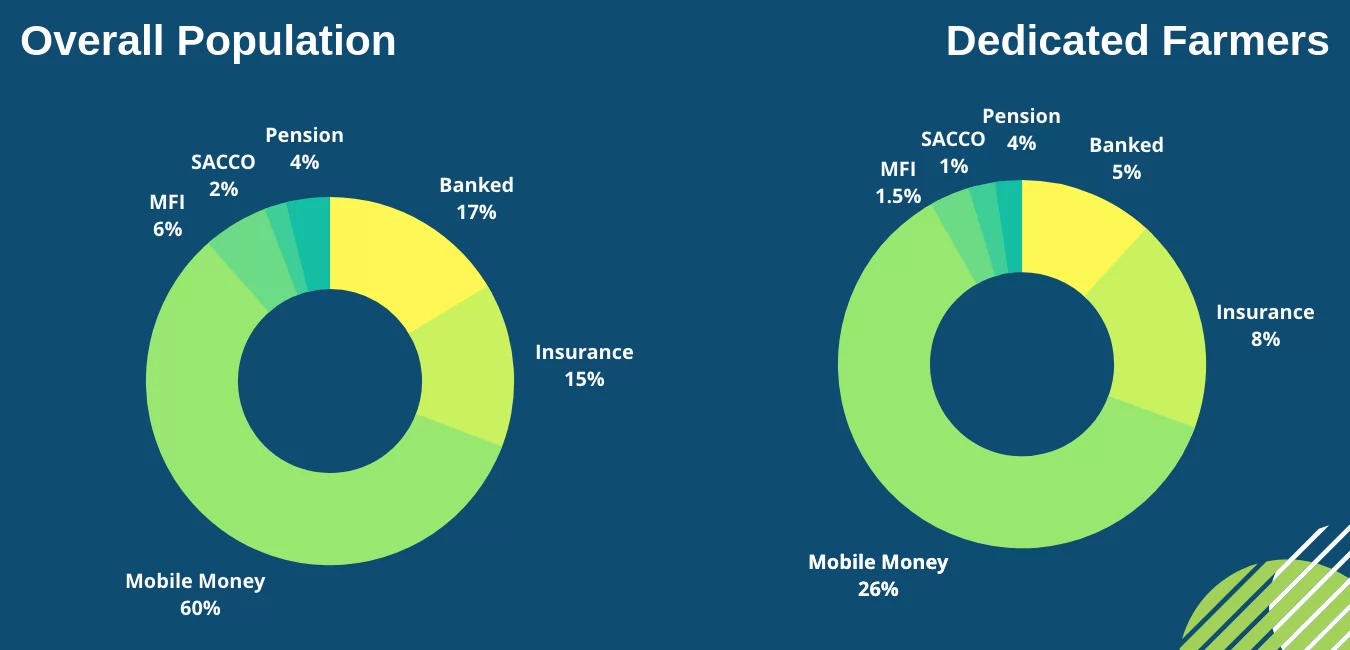

Evidence shows that overall take-up of formal financial services is lower than the national average. With the potential economic contribution that the agricultural sector offers and the need for sound financial management to achieve growth, it is significant that, aside from mobile money, under a fifth of agri-business owners use banking, savings, credit and insurance services. It is clear that products need to be better tailored to the demands of agriculture in terms of required conditions and collateral. With low awareness and knowledge of the benefits of financial services among the agricultural sector, marketing and access to clients is also crucial.

Of farmers make up the overall Tanzanian adult population

Of households in the country engage in agriculture

of farmers live within 5km of a financial access point and 93% own a mobile phone

Of dedicated farmers don’t have any formal education

Source: FinScope Tanzania

Challenges

FSDT studies have shown that addressability is not a key issue for the agricultural sector, as the majority of farmers live within 5km of a financial access point and have access to a mobile phone. Although their basic uptake across services has also been increasing, there are opportunities to expand uptake further and to deepen customer usage. Perceptions persist among financial service providers of high risk and low returns for this sector, resulting in few use cases and solutions that meet the needs of agricultural workers.

FSDT studies have shown that addressability is not a key issue for the agricultural sector, as the majority of farmers live within 5km of a financial access point and have access to a mobile phone. Although their basic uptake across services has also been increasing, there are opportunities to expand uptake further and to deepen customer usage. Perceptions persist among financial service providers of high risk and low returns for this sector, resulting in few use cases and solutions that meet the needs of agricultural workers.

For agricultural workers, the benefits of improved access and usage of financial services are considerable, but many face a range of barriers to inclusion:

- A large majority of farmers live in rural areas, reducing their connectivity to a wide range of formal financial products and services

- Very few have completed secondary education and so have low levels of literacy and numeracy, leading to lack of awareness and knowledge of the benefits of financial products and services

- Average income of dedicated farmers is seasonal and over 10% below national average, presenting challenges to meet registration requirements for formal financial services

- Less than half of farmers own land and, among them, the majority do not have proof of ownership, limiting their ability to meet Know-Your-Customer requirements

Of all dedicated farmers in the country still earn less than TZS 2,500 a day

Of farmers receive income in cash

Of farmers have taken up mobile money

7 in 10 Farmers borrow from family and friends

Source: FinScope Tanzania

FSDT’s strategy for farmers

FSDT recognises the significant potential offered by inclusion of farmers in the financial sector. In our role as a thought-leader, we are gathering and sharing evidence to encourage financial service providers and policy-makers to develop market-led solutions and for farmers to see how the benefits of formal services could improve the livelihoods of their families and communities. Galvanising new thinking and building capacities on both the supply and demand sides of the agricultural sector is a key priority across all our work.

FSDT recognises the significant potential offered by inclusion of farmers in the financial sector. In our role as a thought-leader, we are gathering and sharing evidence to encourage financial service providers and policy-makers to develop market-led solutions and for farmers to see how the benefits of formal services could improve the livelihoods of their families and communities. Galvanising new thinking and building capacities on both the supply and demand sides of the agricultural sector is a key priority across all our work.

FSDT projects

[1] Tanzania Economic Outlook 2016 – The Story Behind the Numbers (Deloitte, Page 11). Accessible online: https://www2.deloitte.com/content/dam/Deloitte/tz/Documents/tax/Economic%20Outlook%202016%20TZ.pdf.